Amazon, one of the companies that benefited the most from the pandemic as shoppers shifted towards online shopping, is now experiencing a significant slowdown as consumer behavior started to change.

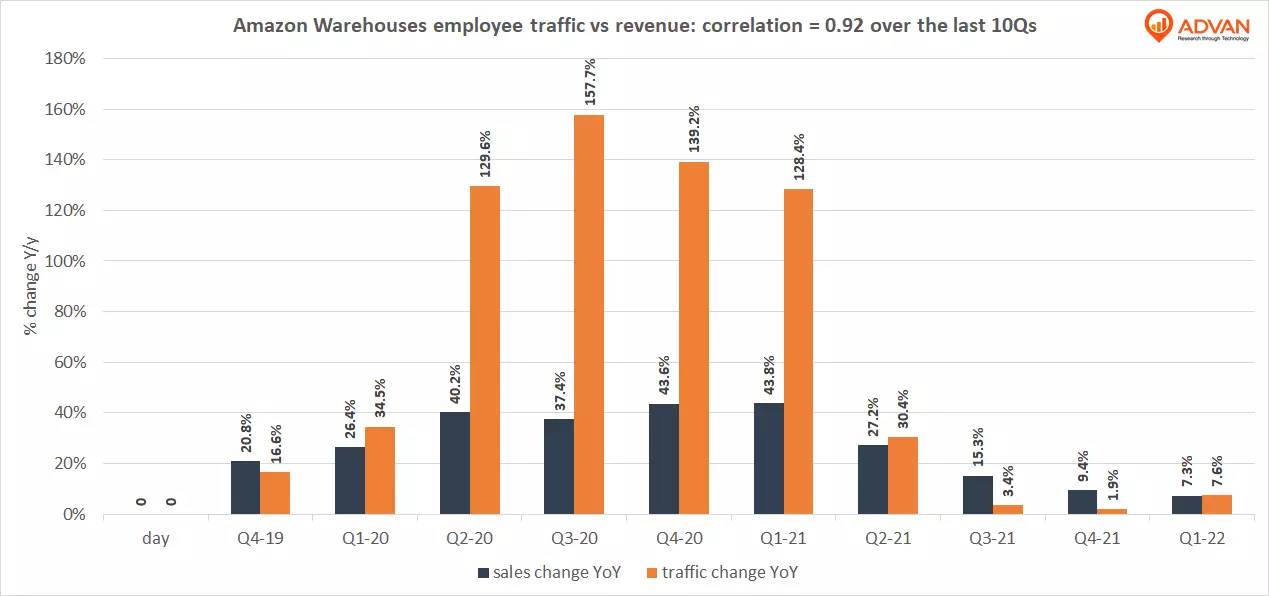

On Thursday April 28, 2022 the company reported $116.4 billion in revenue for the quarter that ended on 3/31, up 7.3% from a year earlier however it was Amazon’s slowest quarterly growth in years: down from 44% revenue increase in 1Q21. Advan’s data shows the negative growth in Amazon’s employee traffic of +7.6% Y/y across all of its warehouses in the US and in line with the year over year revenue growth of +7.3% for the first quarter of 2022 which is nowhere near the 44% increase of the same quarter last year.

For the second quarter of 2022, Advan’s employee counts indicate that the growth is slowing even further with preliminary data measuring +1.4 Y/y. The company also failed to meet Wall Street’s expectations putting extra pressure on Amazon’s shares which fell 10% after the earnings announcement.

Employee traffic at Amazon Warehouses has 0.92 correlation with the company’s the top-line revenue over the last 10 fiscal quarters.