By Thomas Paulson, Head of Market Insights

Lately, we’ve read some commentary that CEO Brian Niccol’s plan to turn Starbucks around has failed to turn the business, because the brand has lost some wallet share. However, Niccol didn’t plan an immediate turn; he has planned for a long-term sustained improvement in the business. A key strategy of the plan is to return Starbuck’s status as a “third place,” which in a fashion is customer love for the brand. Over time, that love will express itself in more time in its coffeehouses, more spend per visit, and more trust (v-a-v more items purchased per visit). Transaction data is a lagging indicator of “love.” Increasing time spent at the coffee house (dwell time) is a leading indicator of “love.”

On the last earnings call, Niccol said, “Over the past 4 months, we've been focused on getting Back to Starbucks and those things that have always set us apart, a welcoming coffeehouse where people gather and where we serve the finest coffee handcrafted by our skilled baristas. We believe it's the fundamental change in strategy we needed to solve our underlying issues, restore confidence in our brand, and return the business to sustainable long-term growth. While we're only one quarter into our turnaround, we're moving quickly to act on the Back to Starbucks efforts we outlined on our last call, and to date, we've seen a positive response... To be clear, these results have room for improvement but I'm confident the disciplined investments we're making in labor, marketing, technology, and stores this fiscal year will help stabilize the business and position Starbucks for future growth.… Our path Back to Starbucks in the U.S. is driven by four core initiatives: Reintroduce Starbucks to the world; deliver the customer experience to win the morning; reestablish Starbucks as the community coffeehouse; and ensure Starbucks is the unrivaled best job in retail, recognizing our success starts and ends with our green apron partners.

During the quarter, we moved quickly to refocus the business, our mission, and our marketing to align with our core identity as the premier purveyor of the finest coffee in the world. We started by reducing the frequency of discount-driven offers, resulting in 40% fewer discounted transactions year-over-year… Through the quarter, we saw a shift in our sales mix towards coffee and espresso-based beverages, which overdelivered and compensated for lower-than-expected performance across our holiday promotions.”

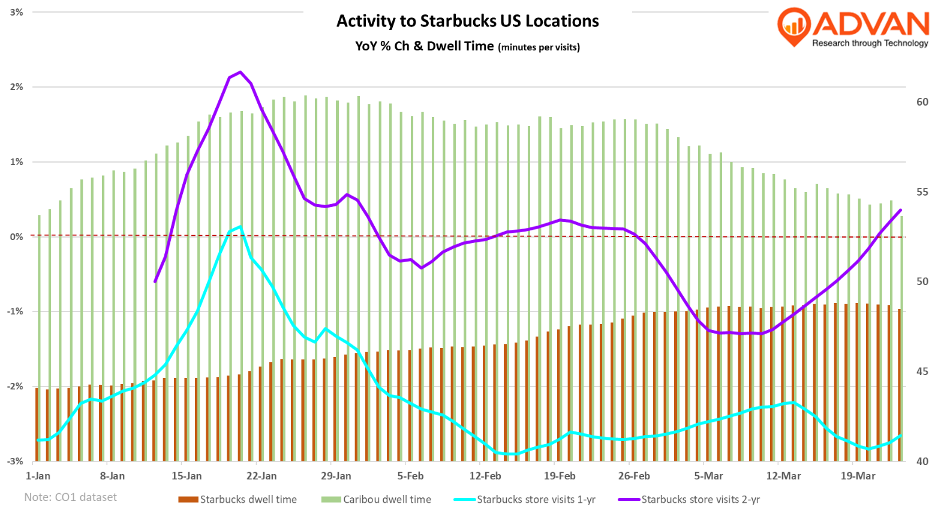

As shown in the chart above, Starbuck’s dwell time has improved nicely so far when using Caribou as a benchmark. Yes, Starbuck’s in-store coffeehouse visits are down on a 1-year basis however, on a 2-year basis, visits have trended around flat. That 1-year trend is also impacted by the reduction in discounted transactions that Niccol mentioned. As such, based upon Advan’s signal, Niccol’s plan for the US looks to be working as intended.

Thomas has been Head of Market Insights for Advan Research since January 2025. Previously, he served as Director of Research and Business Development at Placer.ai, where he was instrumental in providing actionable insights derived from location analytics and the path for expansion into new verticals. His extensive background also includes two decades as a Wall Street analyst and portfolio manager in asset management at Alliance Bernstein, Cornerstone, and others. Linkedin profile.