By Thomas Paulson, Head of Market Insights

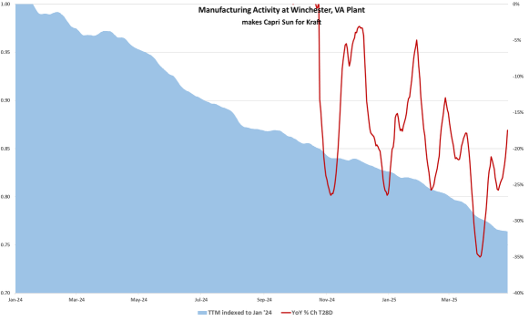

In the context of ongoing weak earnings results for Kraft Heinz and other branded food names, we took a deeper look into Trader Joe’s and Aldi’s traffic growth. Recall that one of our central themes is that industry growth of food-at-home will be driven by private brands and those retailers that excel at it. That’s principally the reason behind the -7% decline in volume and revenue for Kraft’s North American business segment in Q1. That decline now puts volumes down -17% vs. 2019, wow! Lower volume also means less manufacturing activity for Kraft’s plants and their communities. Kraft’s Winchester plant makes Capri Sun, which has fallen out of favor with consumers, and activity (shifts worked, trucks loaded, etc.) is down particularly hard. Declining volumes and activity aren’t just Kraft, sibling Mondelez (Oreo, Ritz, Wheat Thins, etc.) also reported a -3% volume decline for its North American segment despite having more consumer on-trend brands, i.e. it’s a sector thing.

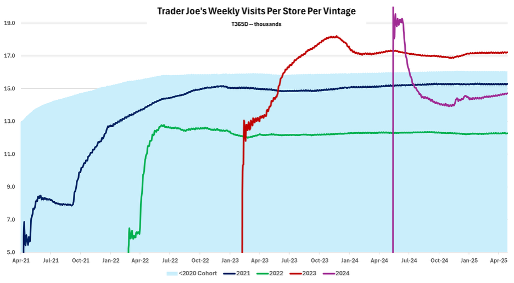

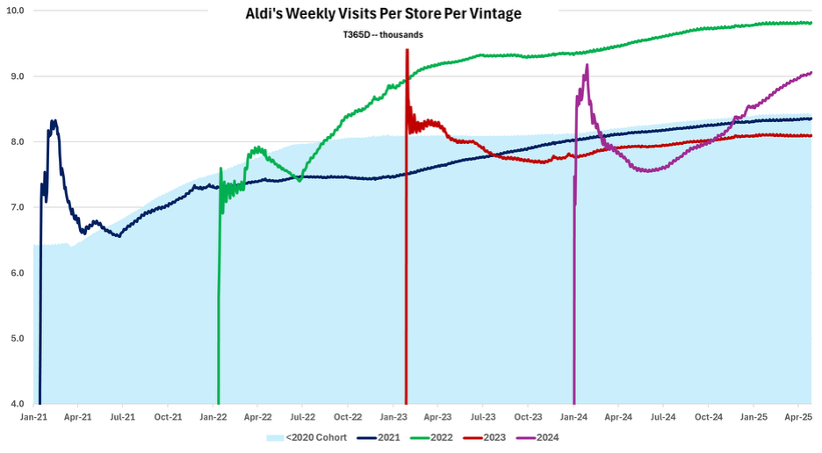

Where that volume is going is to Trader Joe’s and Aldi’s private brands (as well as to Costco, Sam’s, Walmart, etc). Both companies are growing their businesses from a combination of comp-growth and from more locations. The charts below show visitation to Trader Joe’s and Aldi by the business’ locations that existed before 2021 and then with each added class of openings; since 2020, Trader Joe’s has added 67 locations and Aldi, 388. Some classes have performed better / worse depending upon the dynamics of markets that they expanded in. However, one can see that the base business has continued to grow and each of the cohorts have continued to grow. That growth is moving substantial market and consumption share.

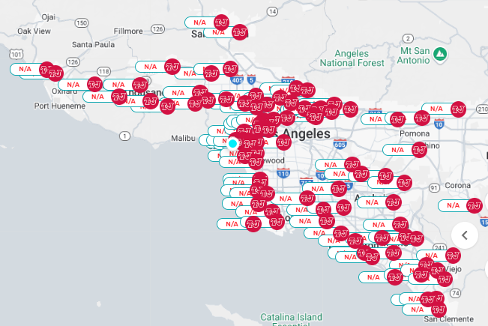

In Trader Joe’s case, the base business has grown traffic about +0.5% annually over the past two years, to that, the 2021 class added 3% in growth, the ’22 class 1.6%, the ’23 class 1.5%, and the ’24 class 3.4%. The class of ’24 was much larger at 34 locations. The class ’22 has underperformed the other classes in performance per location; there were 10 locations in the class and smattered across the US in what mainly looks to be market densification. The class of ’23 has been the star performer with visits / location above the base business, but there are only four locations (albeit well considered ones) in the class. For 2025, 21 new locations are planned , with four of those around the LA region. As the map below shows, Trader Joe’s has a large footprint in the region, but there is still amble room to edge-out and in-fill. Interestingly, the region’s Trader Joe’s (84) are growing nicely on a comp-store sales at a mid- to high-single-digit rate have yet to reach the nationwide average; attributes demonstrating that the business in the region is far from mature.

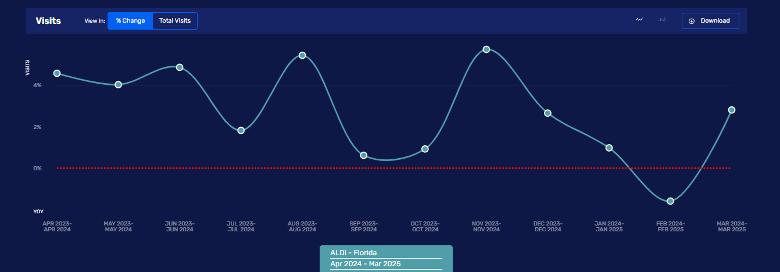

In Aldi’s case, the base business has grown traffic about +2.8% annually over the past two years, to that, the 2021 to ’24 each have added 4% to 6% to growth, i.e. double that of Trader Joe’s. Aldi has also added substantially more locations annually at around 105, which yields about 3.5% annual unit expansion. As shown in the graph, the class of ‘22 has been the star performer, but each of the others have performed well relative to the base; moreover, each are up over the past year increasing by 2-3%. A large chuck of the class of 2022 was in the South East. Looking at just the Florida market, where they have 222 locations, the second chart below shows that visits per location in Florida have consistently increased over the past year. (February is down due to the absence of Leap Day). Moreover, the business drove a +6% increase in shopper frequency. By contrast Publix, which has nearly 900 locations in the market, experienced a 2% decline in shopper frequency. At Publix is where you find Kraft and Mondelez products, and not at Aldi. Thus, the two’s declines in volume and share-of-stomach. For 2025, Aldi plans 225 new locations, including converted Winn-Dixie and Harvey’s locations. (More on this story in the months to come.)

Thomas has been Head of Market Insights for Advan Research since January 2025. Previously, he served as Director of Research and Business Development at Placer.ai, where he was instrumental in providing actionable insights derived from location analytics and the path for expansion into new verticals. His extensive background also includes two decades as a Wall Street analyst and portfolio manager in asset management at Alliance Bernstein, Cornerstone, and others. Linkedin profile.

LOGIN

LOGIN