Grocery Outlet Holding announced Q4 results along with a new CEO, Jason Potter – The Fresh Market’s recent CEO, and a restructuring program. (The CEO change was expected) This follows the appointment of its new CFO / CIO in January – Chris Miller from Shamrock Foods. The restructuring program notably: (1) lowers the unit expansion rate to 34 new locations (down from the prior plans 54), (2) seeks to terminate leases for some of the unopened stores, (3) includes warehouse project cancelations, and (4) involves layoffs. As a reminder, the company has suffered in-stock issues since last summer when IT systems upgrades went bad. That has also led to margin pressure from missed sales and increased spoilage. CFO Miller stated that Q4 results were still marked by “significant ongoing issues with supply.” 2025’s new store expansion program narrows the focus to infill and adjacencies (i.e. market densification) as new markets are too dilutive to its financials at the moment. Additionally, outgoing CEO Eric Lindburg stated that inflating construction costs were also a factor.

Sales for Q4 increased 11% to $1.098B with comp-sales gaining +2.9%, or slightly ahead of Advan’s $1.090B estimate. The shortfall arises from a lessening of new store productivity; for context, average selling space increased +17% in the period and its contribution to sales growth was only 47% vs. the TTM average of 58%. Comp-sales were transaction-driven with ticket flattish. Given its value / off-price positioning, ticket and UPTs should be higher, but the IT system / in-stock issue is inhibiting that. Management also acknowledged being disappointed by the lack of basket growth. Gross margin declined 70 bps. All of this raises the question of whether the company will need to invest merchandise margin into lower prices to improve its relative value to competitors (per analyst questions on the earnings call). That question / fear drove the stock down sharply with the results.

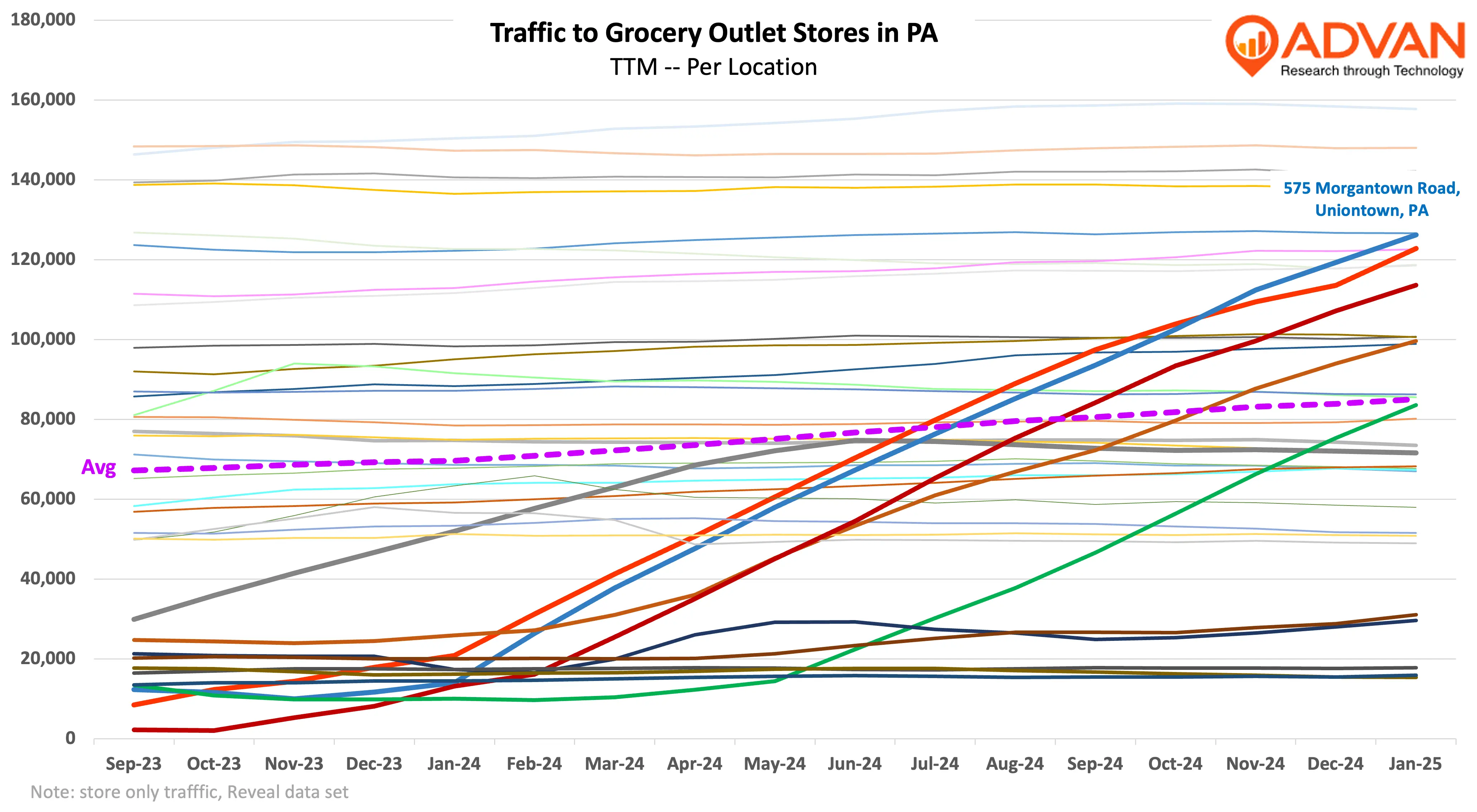

As grocery retail is a very competitive, lower-margin business, generating greater scale efficiencies and increasing market density are critical to shareholder value creation. And so rightly so, the dial-back in expansion plans invites concerns about the long-term margin as well. (Grocery Outlet’s long-term plan is 4K units, up from the current 530.) However, when we delve into some of their current markets, we find encouragement. The chart below shows monthly visits (TTM) to its 35 locations in Pennsylvania. As shown, the five locations opened in 2023 and ’24, such as the one on Morgantown Road, have all ramped nicely and now exceed the market average. Separately, lower volume stores are found in the highly competitive Philadelphia and Allentown markets. However, visits in those markets are up +22% and +33%, respectively, in TTM visits. Finally, the comp-locations as of September 2023, are up +7.5% on the TTM Jan-25 over Jan-24. In the current economic environment, disruptive value is winning consumer visits; that’s what Grocery Outlet is demonstrating in Pennsylvania, and so they know how, if they can remain in-stock.

(Should you like to delve into other Grocery Outlet markets in a Zoomeet, let us know.)

LOGIN

LOGIN