Join our exclusive community and gain access to Advan's latest market insights across industries, including

real estate, retail, CPG, entertainment, travel, healthcare, industrials and more.

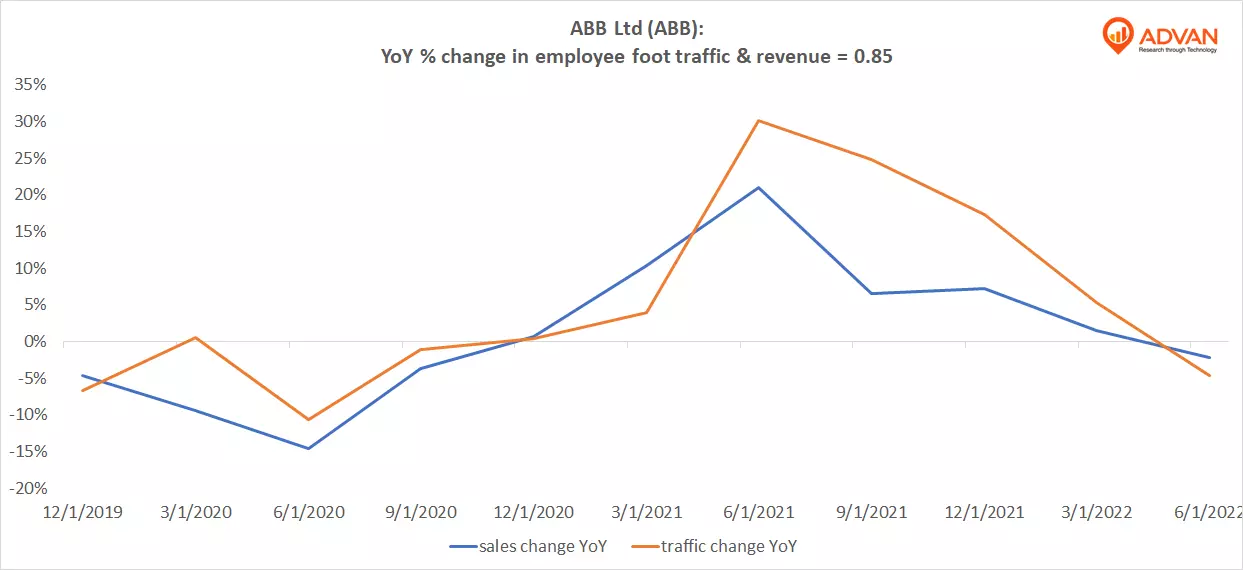

Notable Hit: (ABB:NYSE) On Thursday July 21, 2022 ABB Ltd (ABB) posted worse than expected revenues of $7.27bn missing the consensus estimate of $7.57bn or by -3.9% and in the same direction as Advan's forecasted sales. The revenue was down 2.2% YoY and in line with Advan's employee foot traffic...

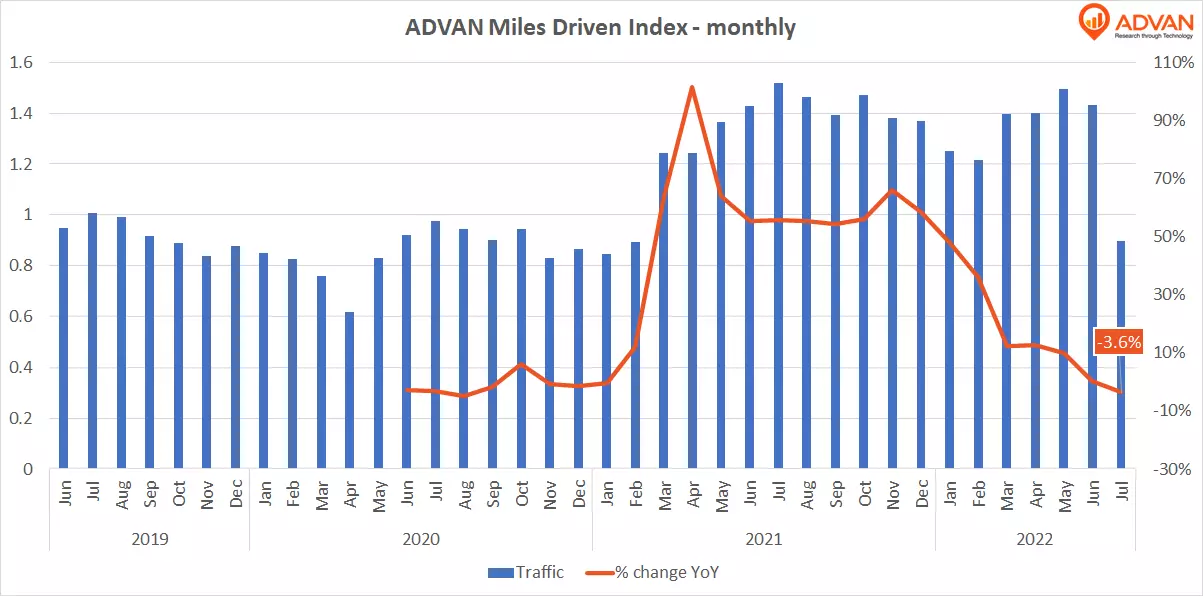

Historically, gas demand has been pretty predictable for any given time of the year, so the supply has been what mostly determined the pricing we see in the pumps. With the advent of remote working and as a result the ability to commute less, however, Americans have at least one lever to reduce the...

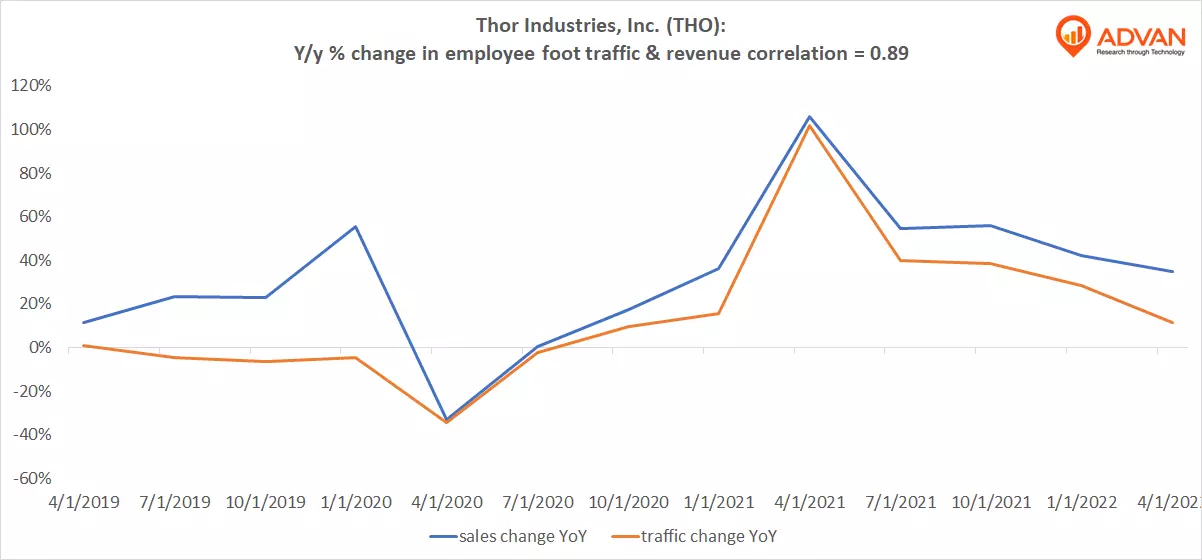

Notable Hit: (THO:NYSE) On Wednesday June 8, 2022 Thor Industries, Inc. (THO) posted better than expected revenues of $4.66bn surpassing the consensus estimate of $4.16bn or by +12% and in the same direction as Advan's forecasted sales. The revenue was up 34.6% YoY and in line with Advan's employee...

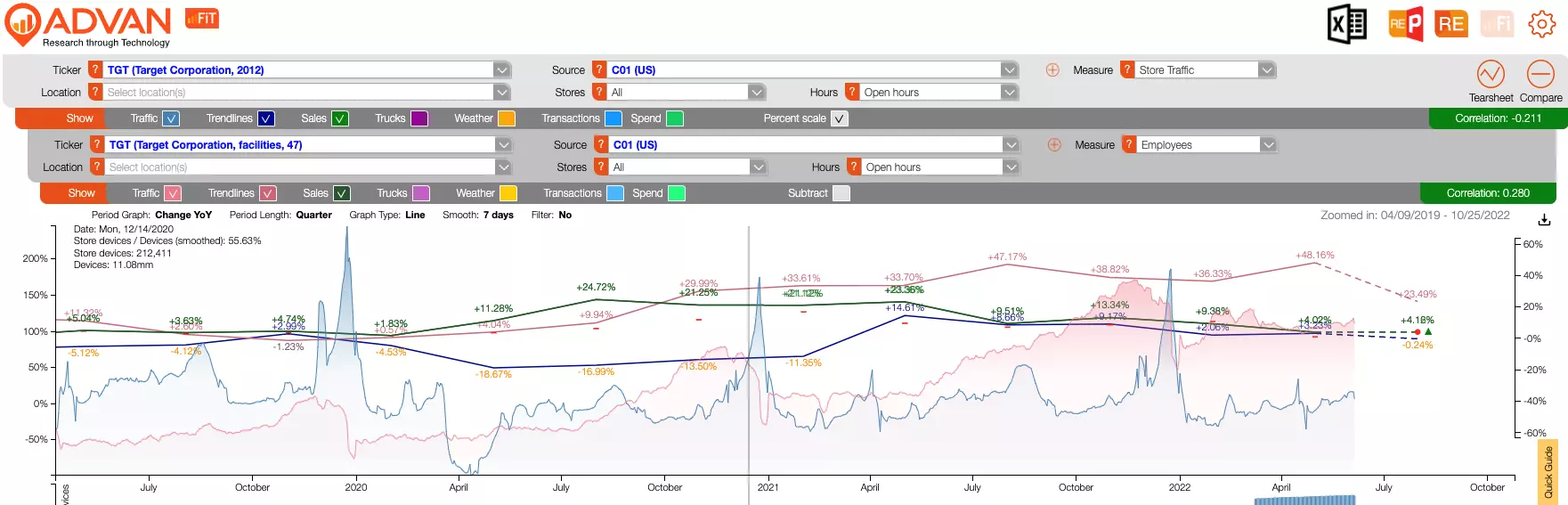

Target (NYCE: TGT) announced today that it expects lower profit due to high inventory.

It is counter-intuitive, but cellphone location data is measuring this discrepancy by monitoring Target’s supply and demand sides.

On the demand side, in the image below we can see foot traffic in Target...

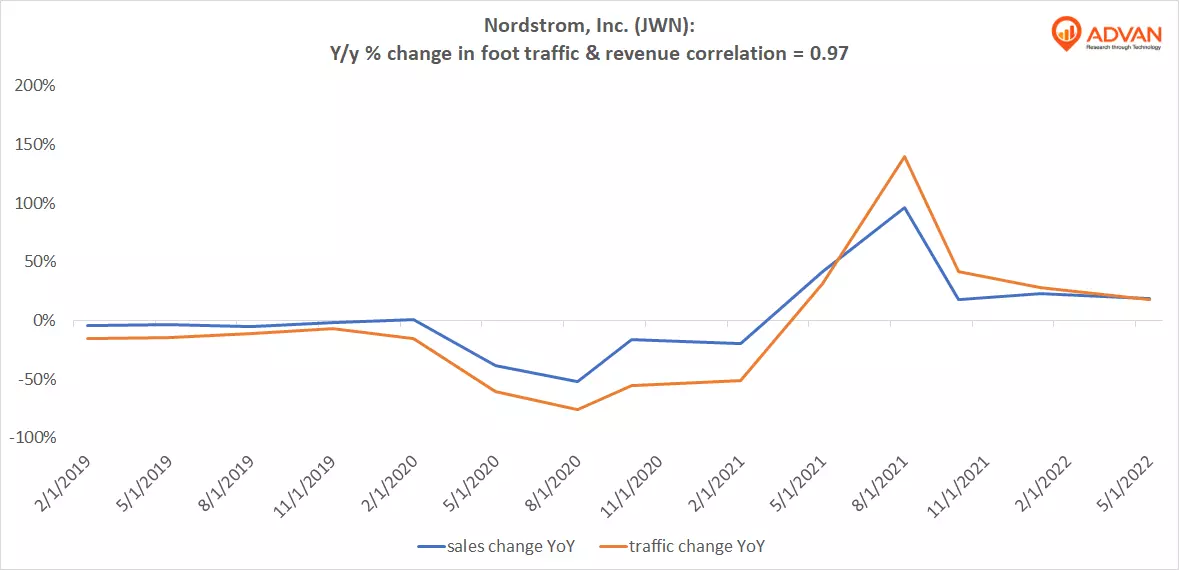

Notable Hit: (JWN:NYSE) On Tuesday May 24, 2022 Nordstrom, Inc. (JWN) posted better than expected revenues of $3.57bn surpassing the consensus estimate of $3.28bn or by +8.84% and in the same direction as Advan's forecasted sales. The revenue was up 18.6% YoY and in line with Advan's foot traffic...

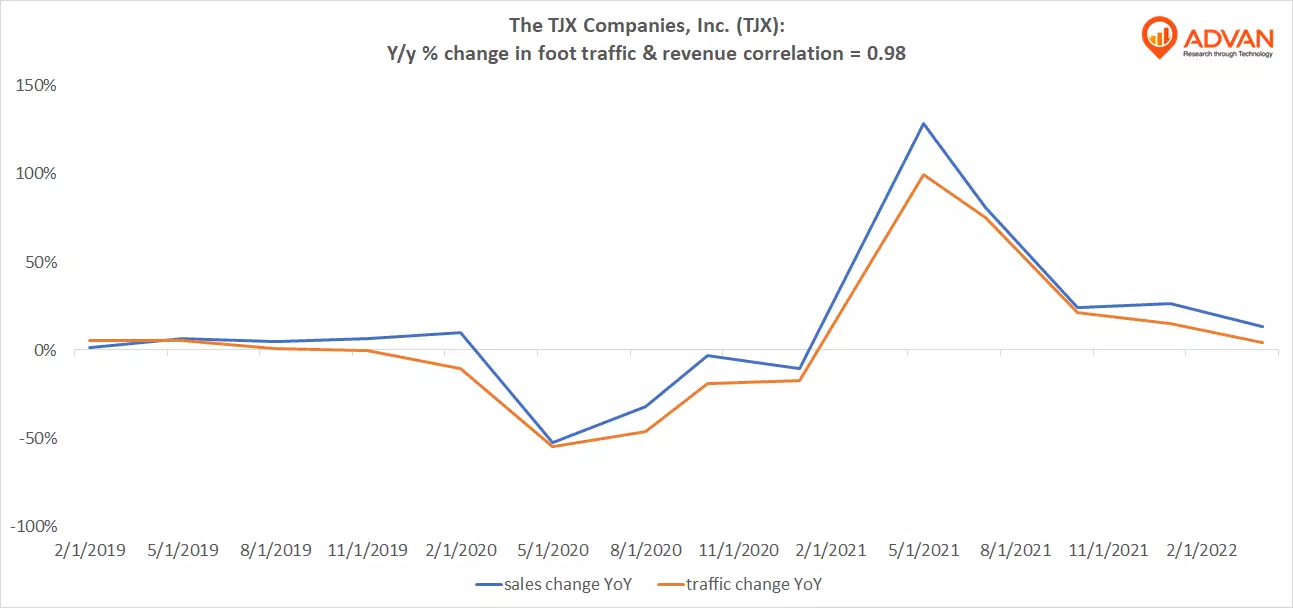

Notable Hit: (TJX:NYSE) On Wednesday May 18, 2022 The TJX Companies, Inc. (TJX) posted revenues of $11.4bn slightly missing the consensus estimate of $11.5bn or by-1.3% and in the same direction as Advan's forecasted sales. The revenue was up 13% YoY and in line with Advan's foot traffic data...

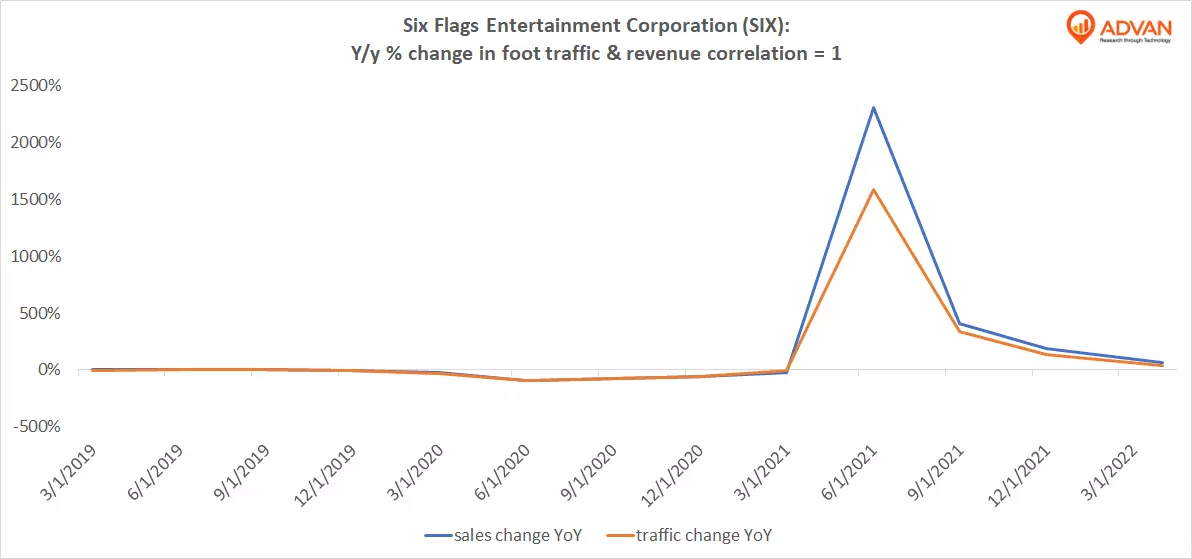

Notable Hit: (SIX:NYSE) On Thursday May 12, 2022 Six Flags Entertainment Corporation (SIX) posted better-than-expected revenues of 138.11mm surpassing the consensus estimate of $121.2mm or by +13.9% and in the same direction as Advan's forecasted sales. The revenue was up 68% YoY and in line with...

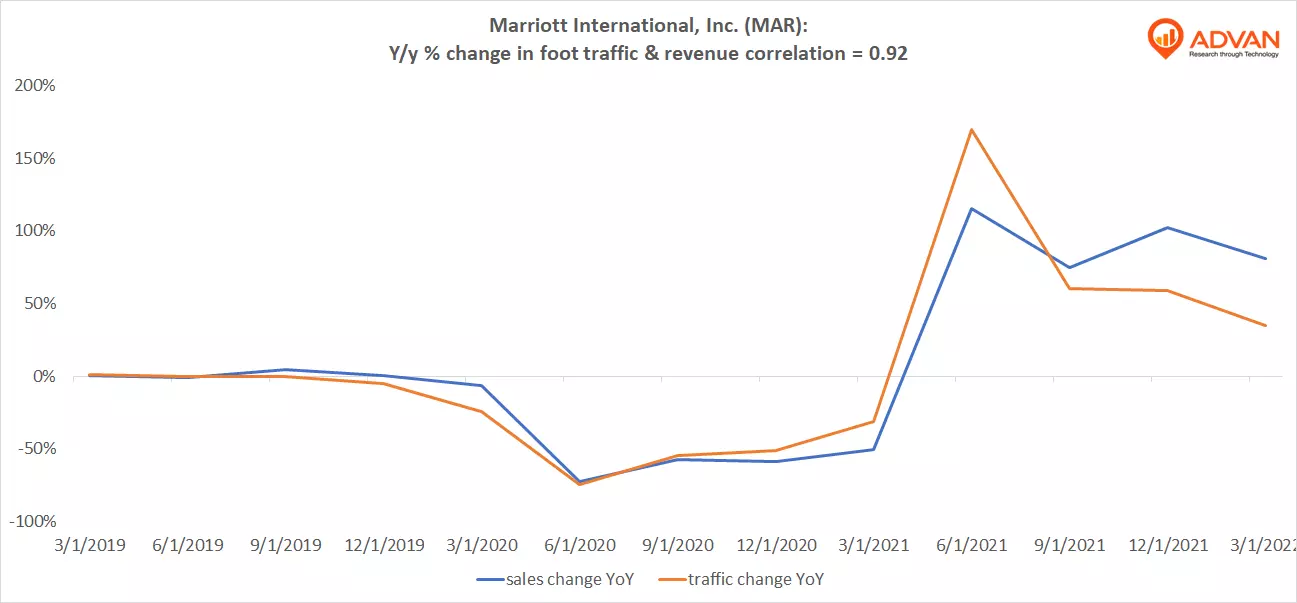

Notable Hit 1: (MAR:NASDAQ) On Wednesday May 4, 2022 Marriott International, Inc. (MAR) posted better-than-expected revenues of 4.2bn surpassing the consensus estimate of $4.15bn or by +1.2% and in the same direction as Advan's forecasted sales. The revenue was up 81% YoY and in line with Advan's...