Join our exclusive community and gain access to Advan's latest market insights across industries, including

real estate, retail, CPG, entertainment, travel, healthcare, industrials and more.

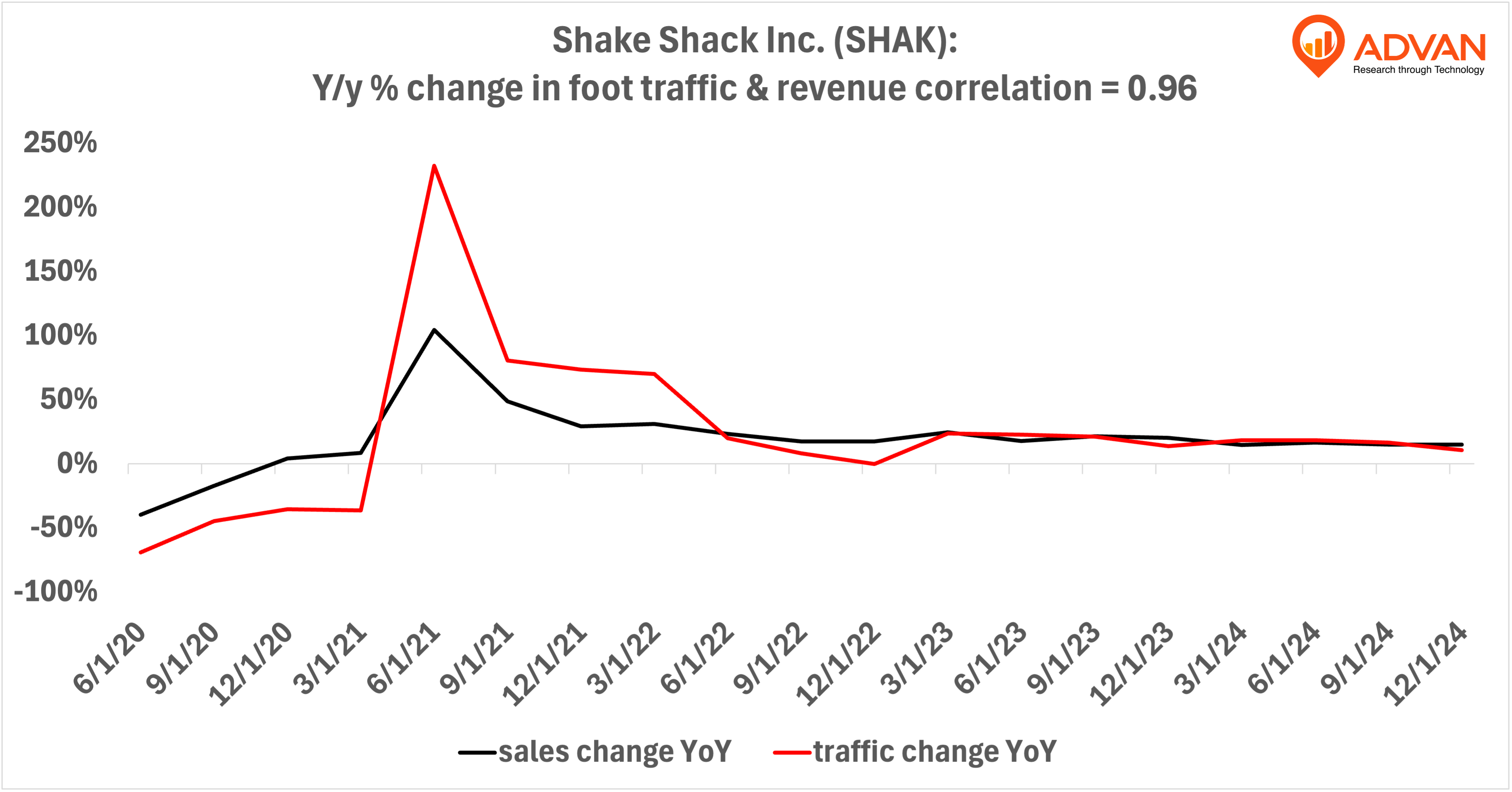

Notable Hit 1: On Thursday February 20, 2025 Shake Shack Inc. (SHAK) posted revenues of $328.7 mm surpassing the analysts estimates by 1% and in the same direction of Advan's implied sales. Advan's data showed a 10.5% increase YoY in foot traffic to its restaurants in Q4 2024; the company's revenue...

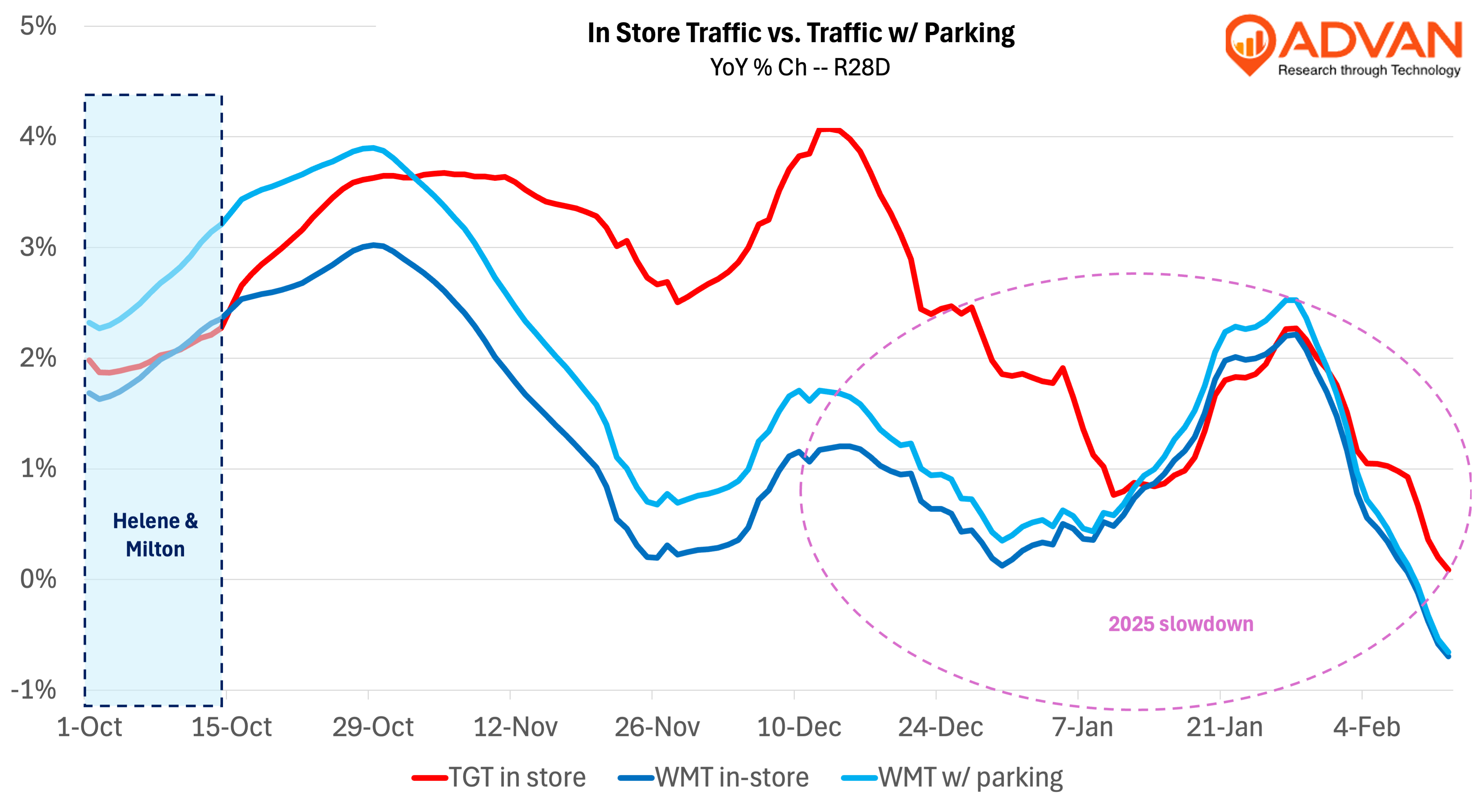

Walmart U.S. Q4 results showed sales up +5.0%, comp-sales up +4.6%, and operating margin up +12 bps. The sales increase was ahead of Advan’s +4.3% estimate* (+/- 90 bps T4Q Moe, 55% T8Q correlation). Excluding e-commerce, curbside, store delivery, and marketplace, comp-sales increased +1.7%....

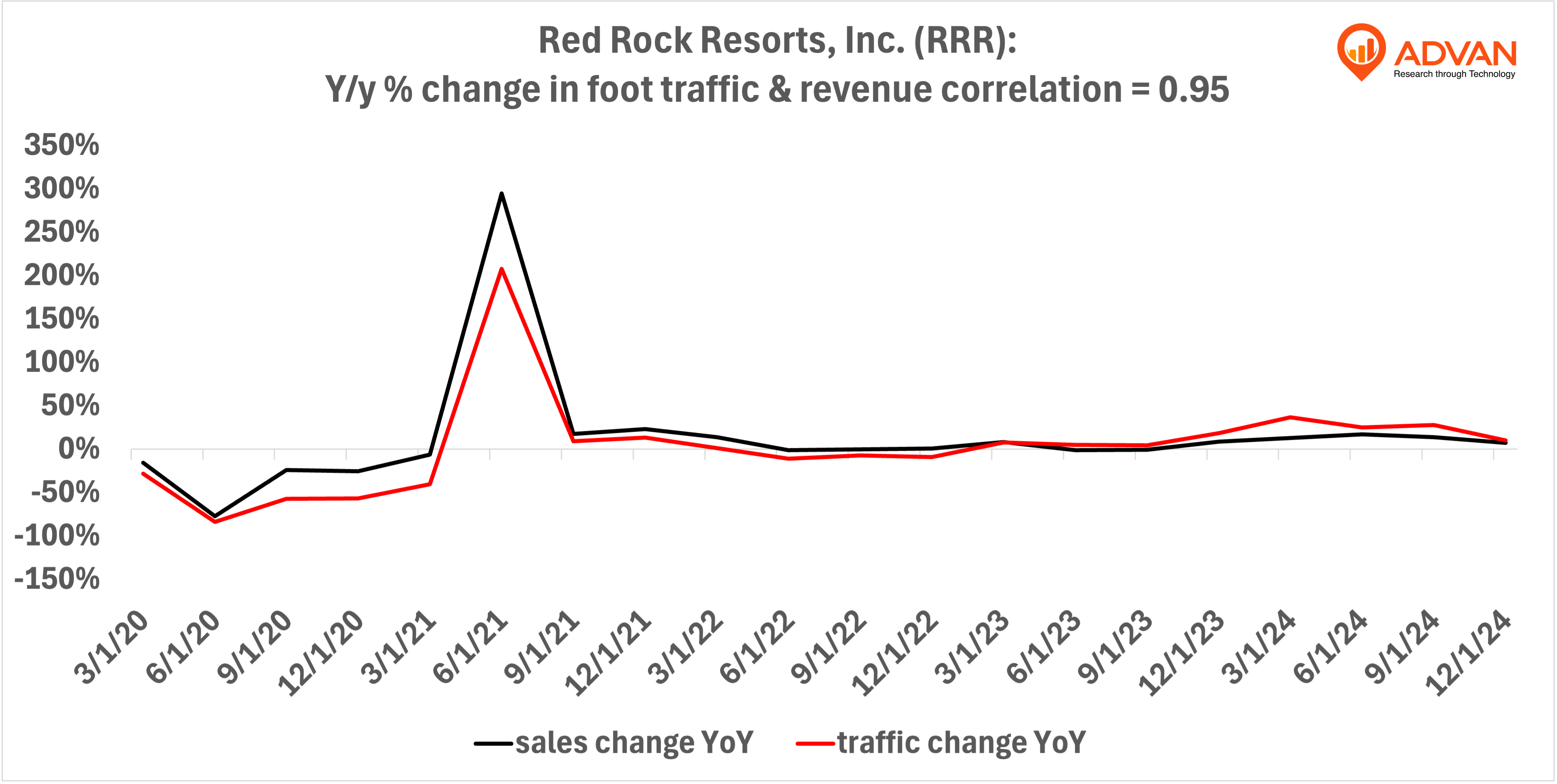

Notable Hit 1: (RRR:NASDAQ) On Tuesday February 11, 2025 Red Rock Resorts, Inc. (RRR) posted revenues of $495.7 mm surpassing the analysts estimates by 0.82% and closer to Advan's implied sales of 492.5 mm (-0.61%). Advan's data showed a 10.1% increase YoY in foot traffic to its resorts in Q4 2024;...

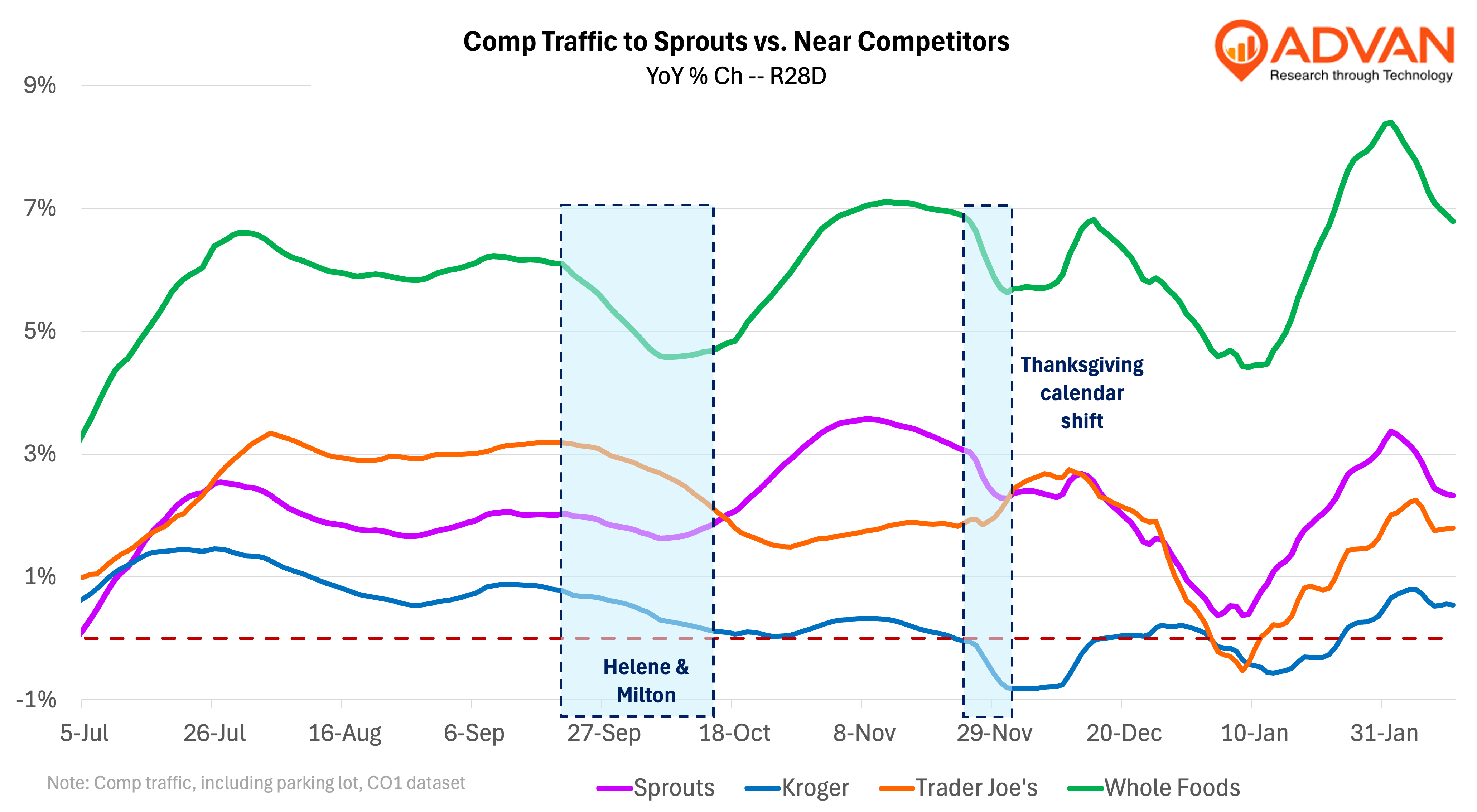

Differentiation was the key to growth in sales and market share in food retail in 2024 -- a challenging year for conventional retailer offerings. As shown above, Whole Foods enjoyed robust comp-traffic all year long, and the traffic aligns with its reported sales growth rate of...

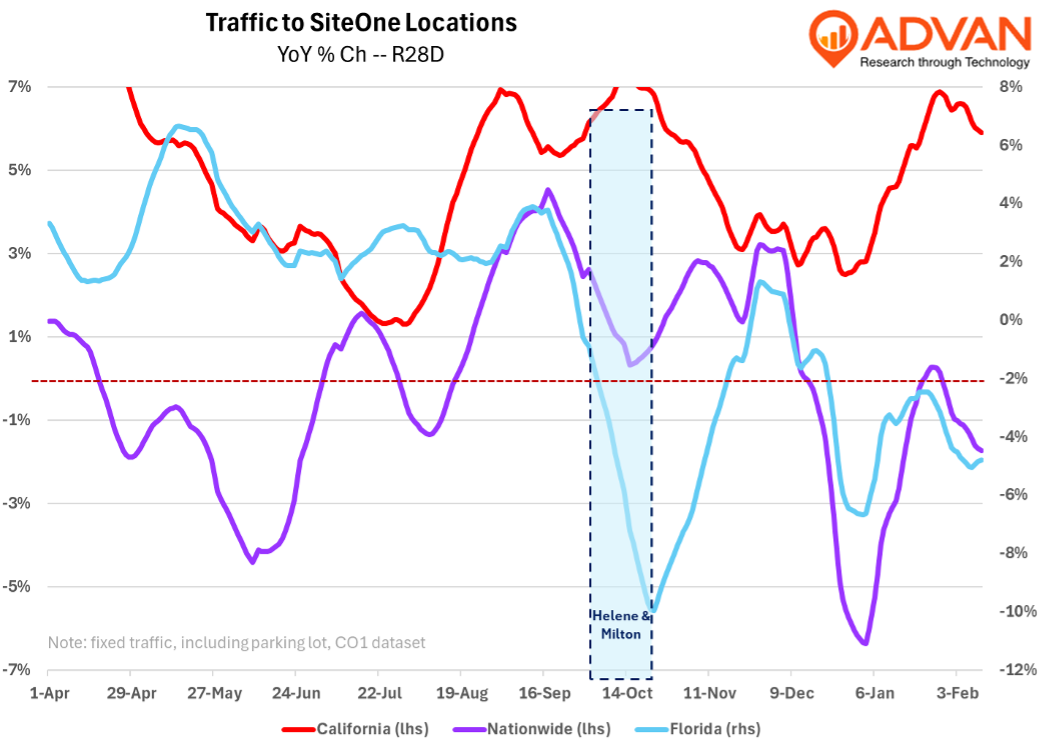

SiteOne’s business and results are interesting these days as they provide a read on the results of immigration policy on industries heavily dependent on immigrants, extreme weather and natural disasters, commodity inflation, and housing. The latter three of these were impactful to SiteOne’s Q4 as...

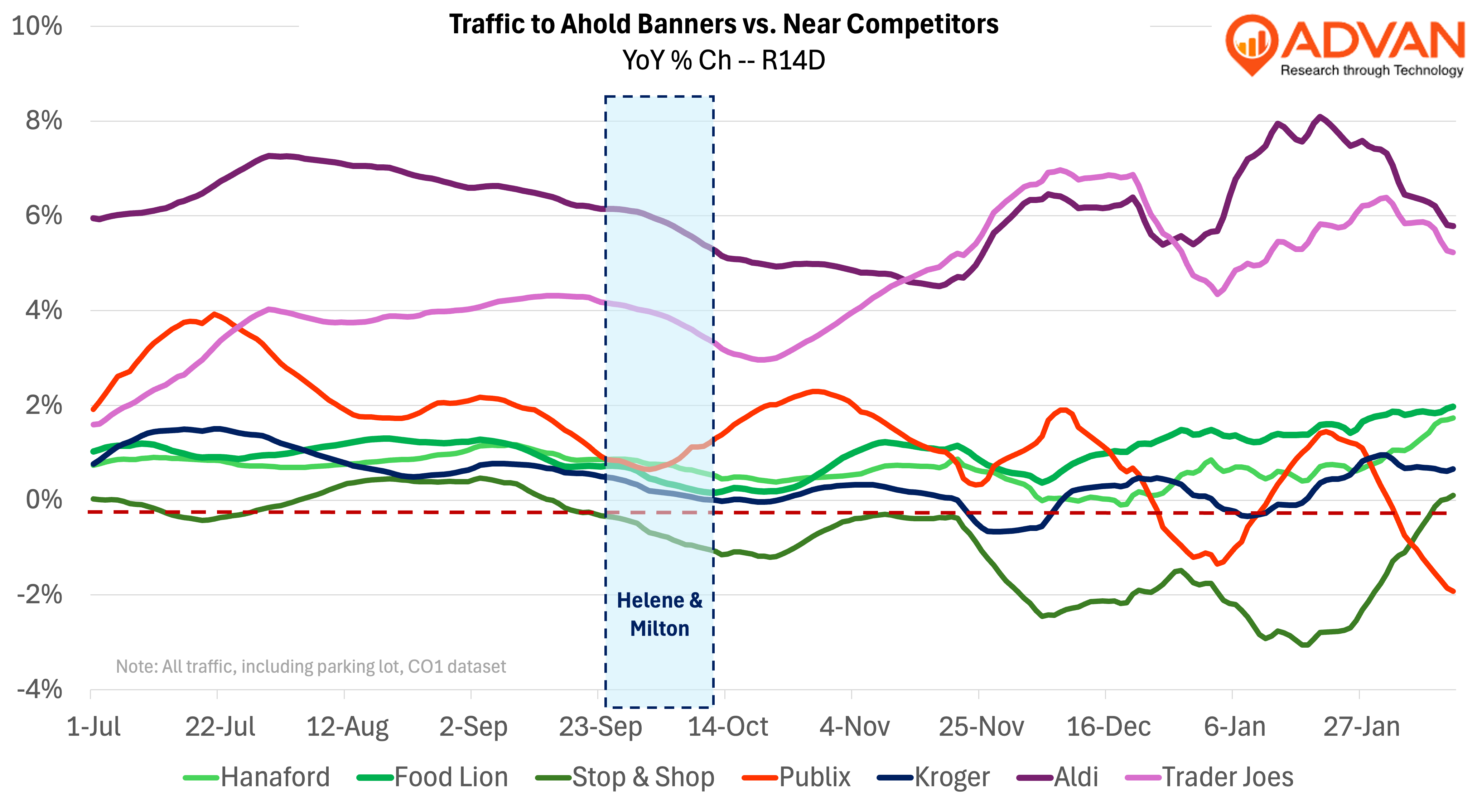

Ahold reported a stronger set of figures for Q4. Per Advan Research, traffic is even better 2025-to-date, including for its Stop & Shop, as shown in the chart below. The improvement is on both a 1-year and 2-year basis for all Ahold brands. On its results, management noted that volumes for the...

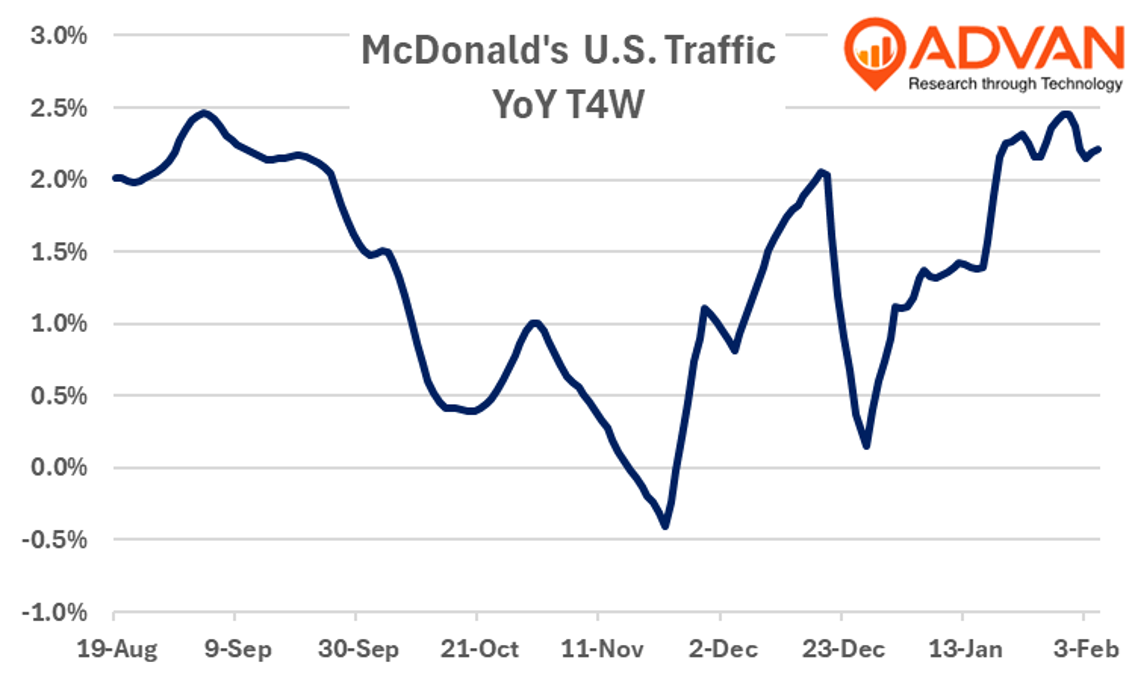

As traffic data and intra-quarter commentary indicated, U.S. comp-sales deteriorated QoQ by -110bps for a -1.4% decline for Q4. Advan Research data showed a -136bps deterioration in traffic and -115bps in spend*. However, since the E. coli scare in October, the traffic and sales trend has...

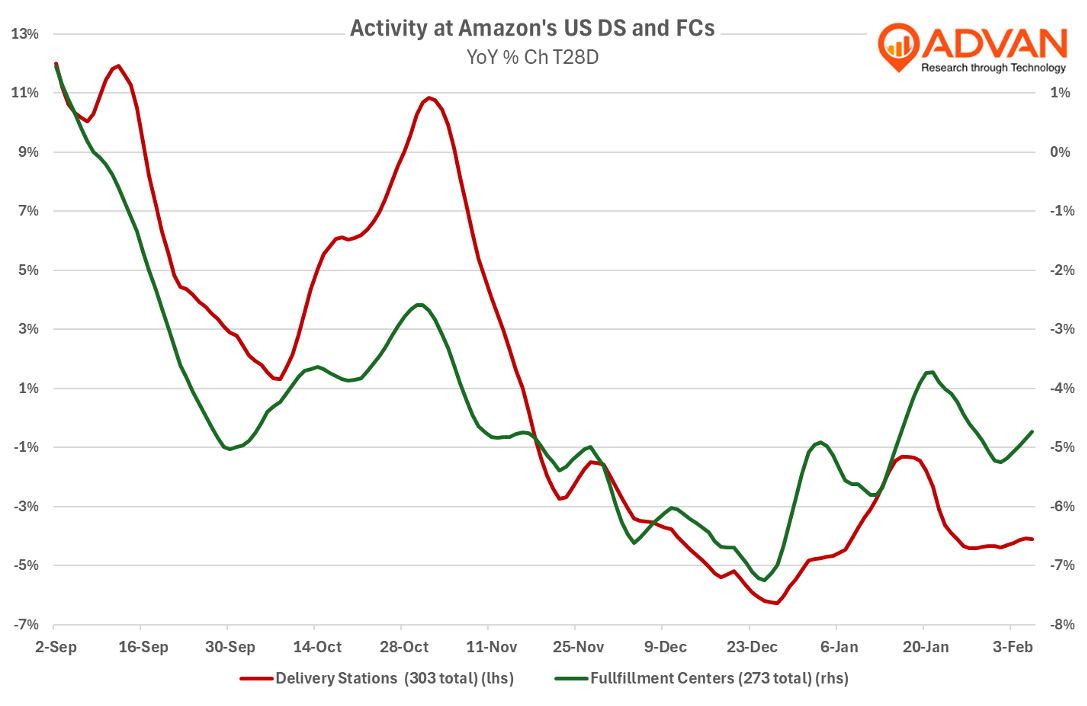

What struck us about Amazon’s Q4 results was the significant upside in its North America margins and profits; margins hit 8.0% vs. the expectation of 6.5% (BBG) and EBIT hit $9.3B vs. the expectation of $7.4B. Amazon has worked diligently to lower the cost to serve since early 2023 by staging...