Join our exclusive community and gain access to Advan's latest market insights across industries, including

real estate, retail, CPG, entertainment, travel, healthcare, industrials and more.

By Thomas Paulson, Head of Market Insights

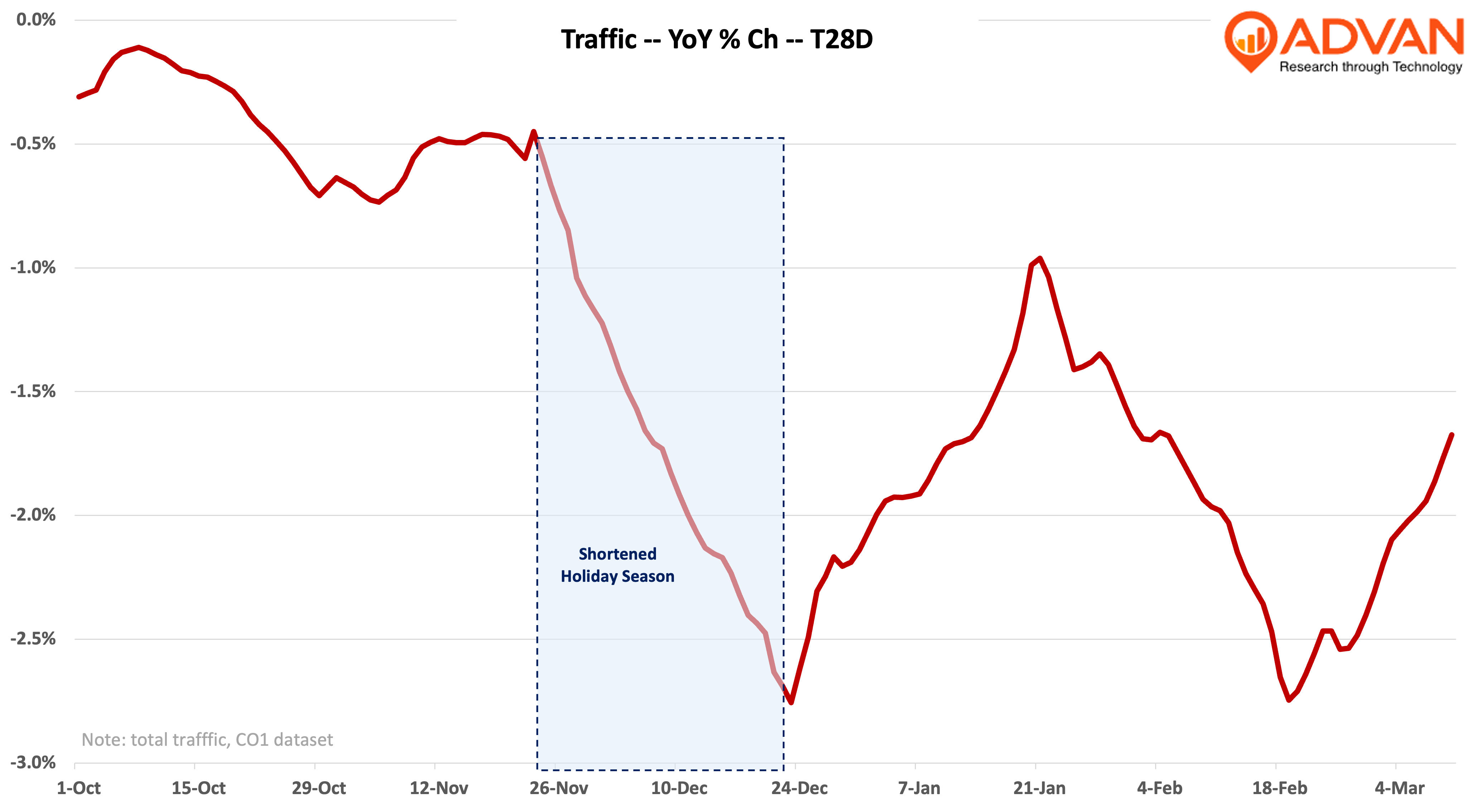

Kohl’s: Quarterly sales were “less bad” at a decline (-9.4%) than our preview (we said -14%). In our preview, we also forecasted that incoming CEO Ashley Buchanan would set a very low bar on forward expectations, he did. Revenue for 2025 was guided for a...

By Thomas Paulson, Head of Market Insights

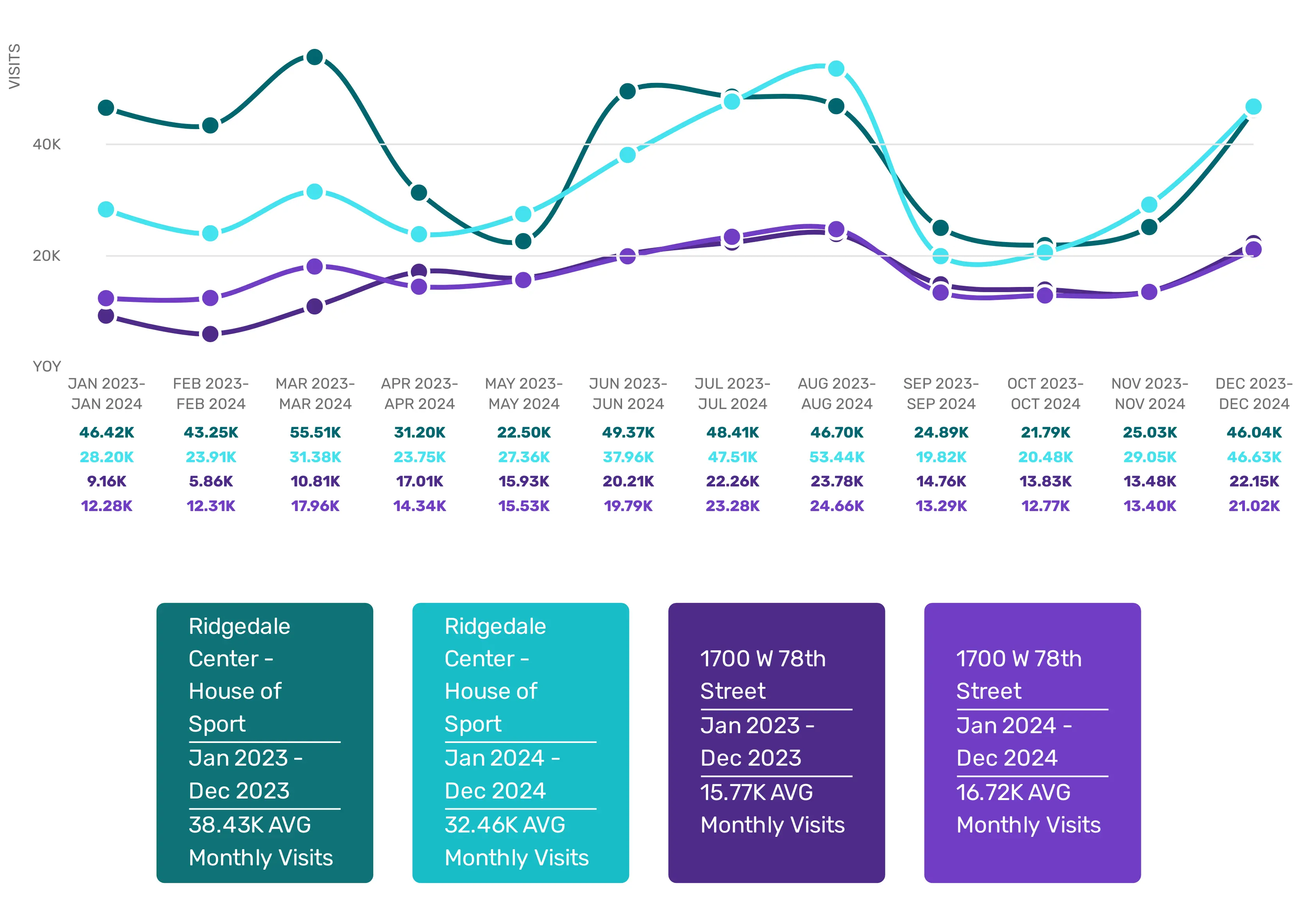

Dick’s Sporting Goods, Inc. reported solid results, including an underlying sales increase of 6% based upon a 6.4% comp-sales increase and improved gross margin rate. The comp-sales increase was composed of increases of 4.4% in comp-ticket, 2.0% in...

By Thomas Paulson, Head of Market Insights

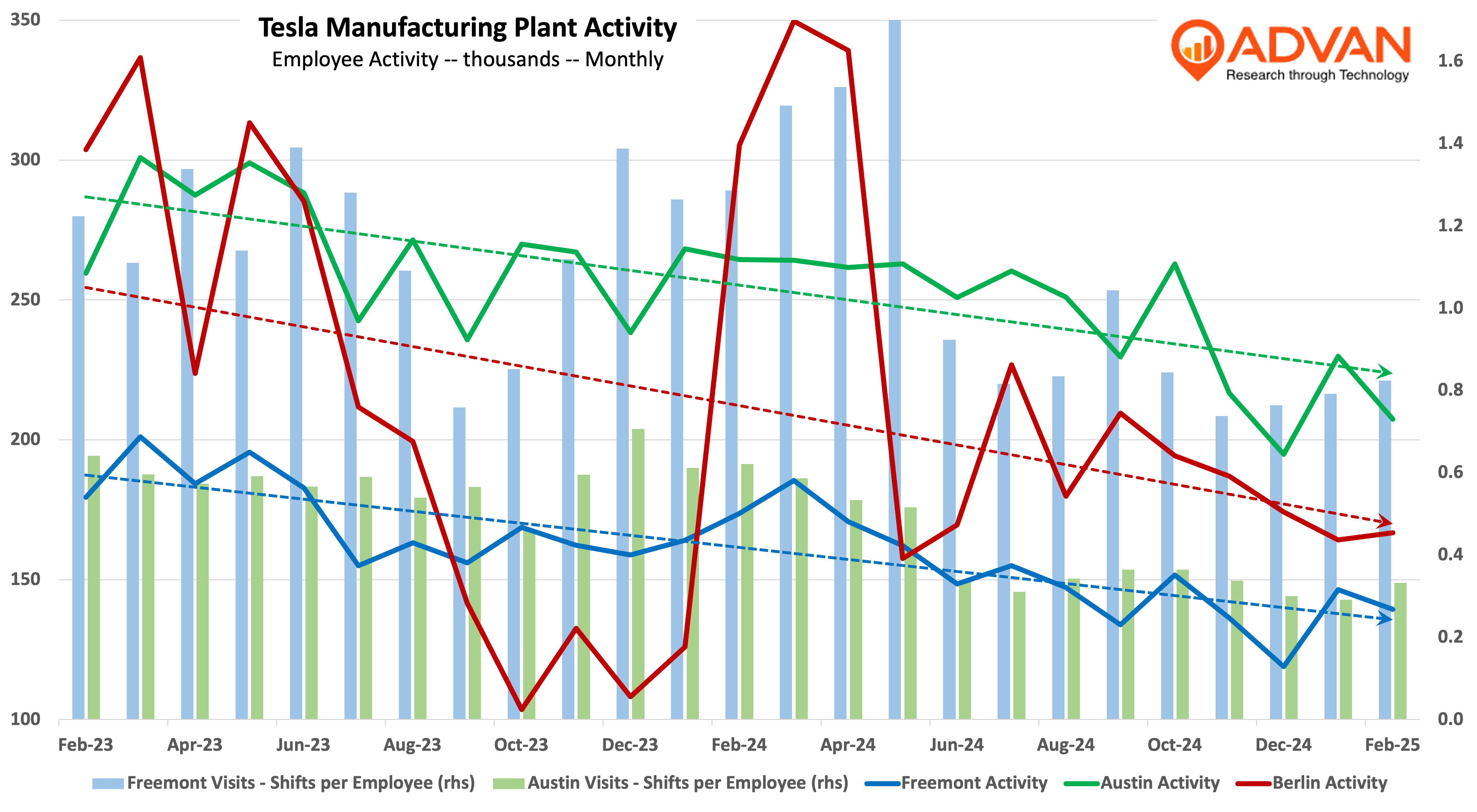

Production activity at Freemont, Austin, and Berlin has stepped meaningfully lower in February, accentuating the negative trend at year end. Clearly, Tesla’s sales and operations team are observing a slackening in demand, confirming industry and press...

By Thomas Paulson, Head of Market Insights

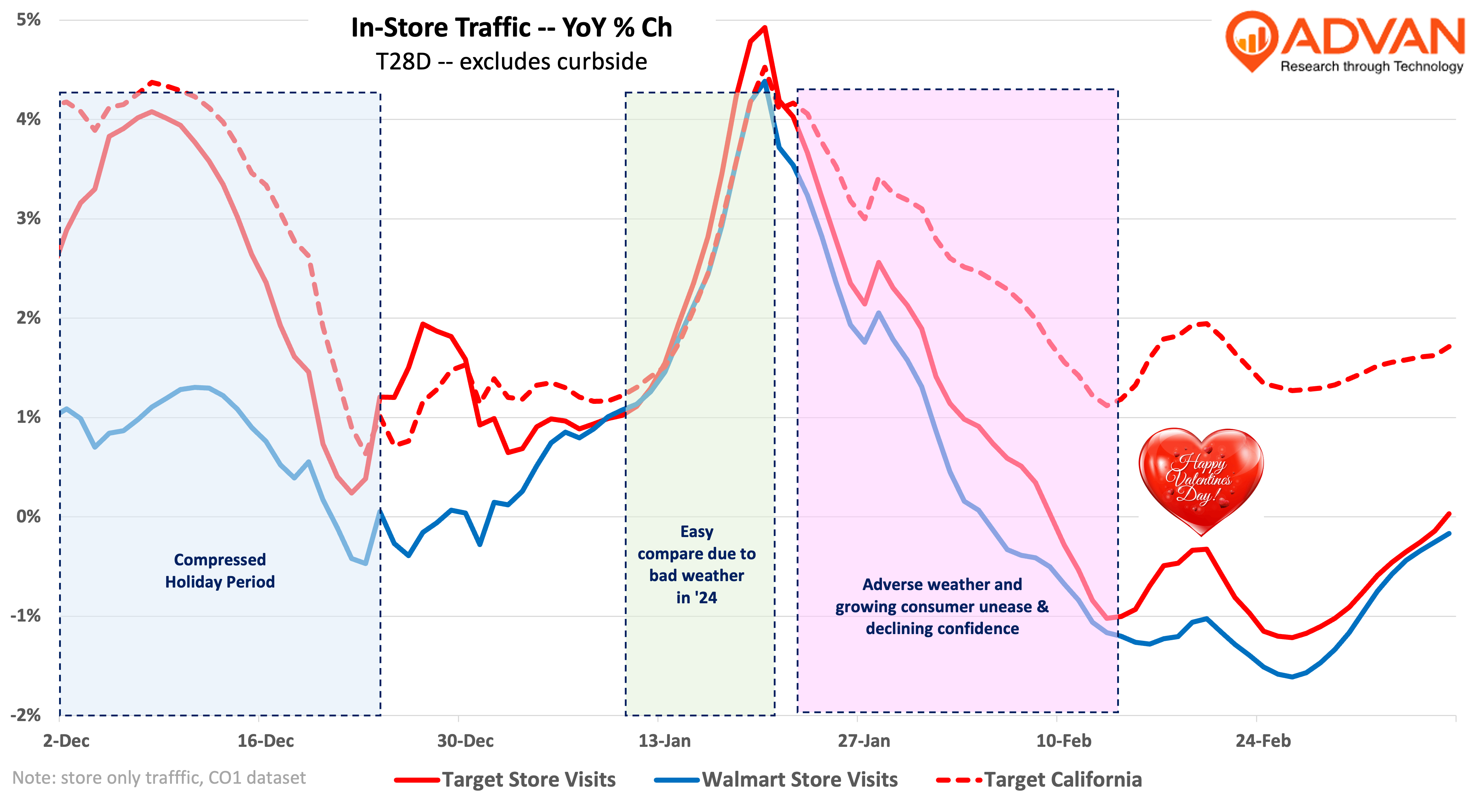

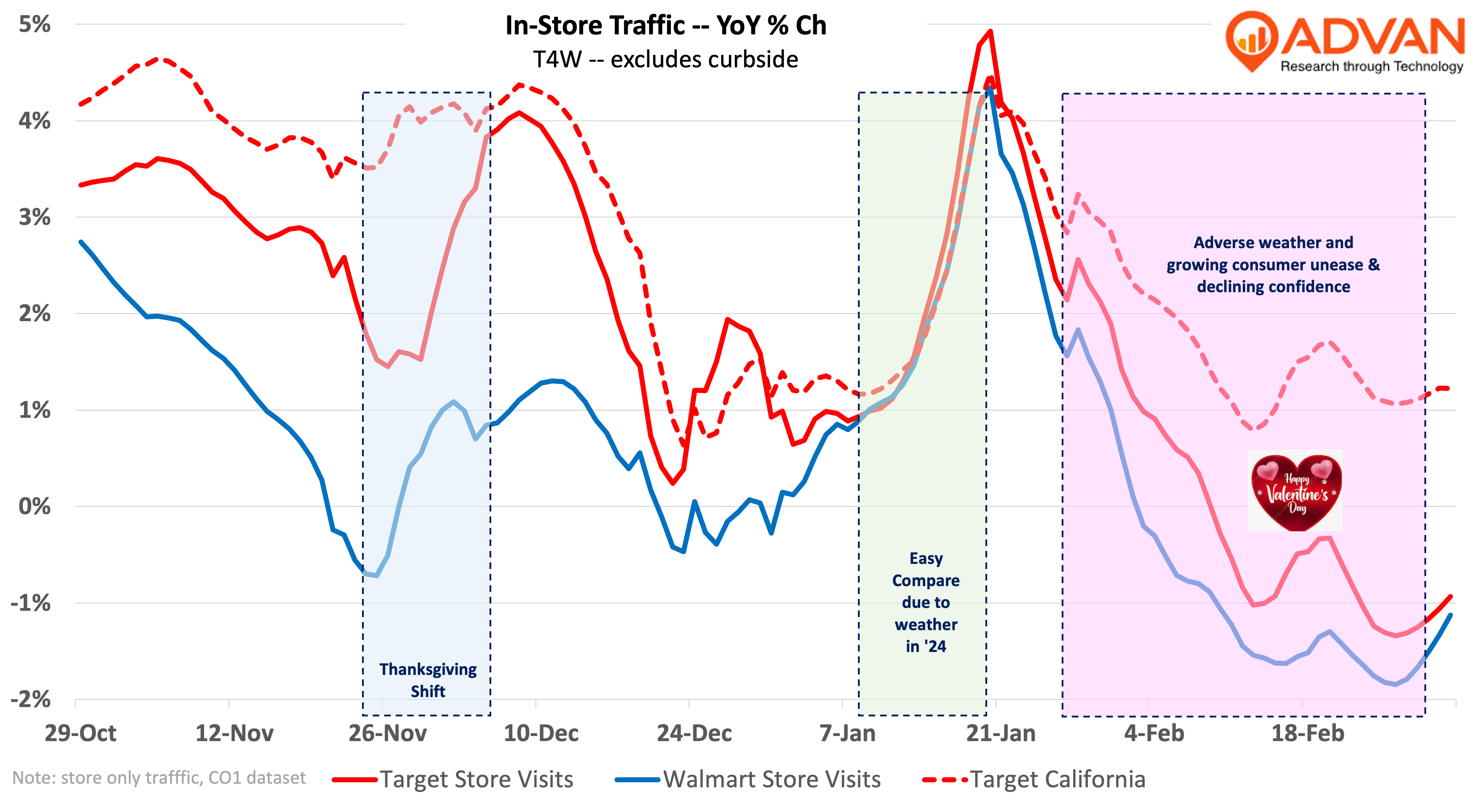

Last week’s analysis included management’s comments relative to any DEI backlash that they were seeing no impact to their business. However, over the weekend, media outlets wrote about a negative impact on Target store traffic and business from the...

By Thomas Paulson, Head of Market Insights

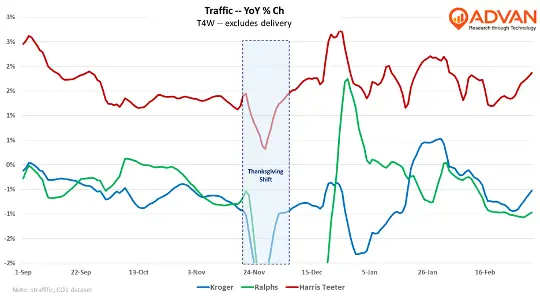

To say that this is a dynamic time for grocery retail is a classic underbilling given the inflationary spiral coming out of the pandemic, the substantial share-of-stomach lost by conventional brands to private-label led retailers such as Trader Joe’s and...

By Thomas Paulson, Head of Market Insights

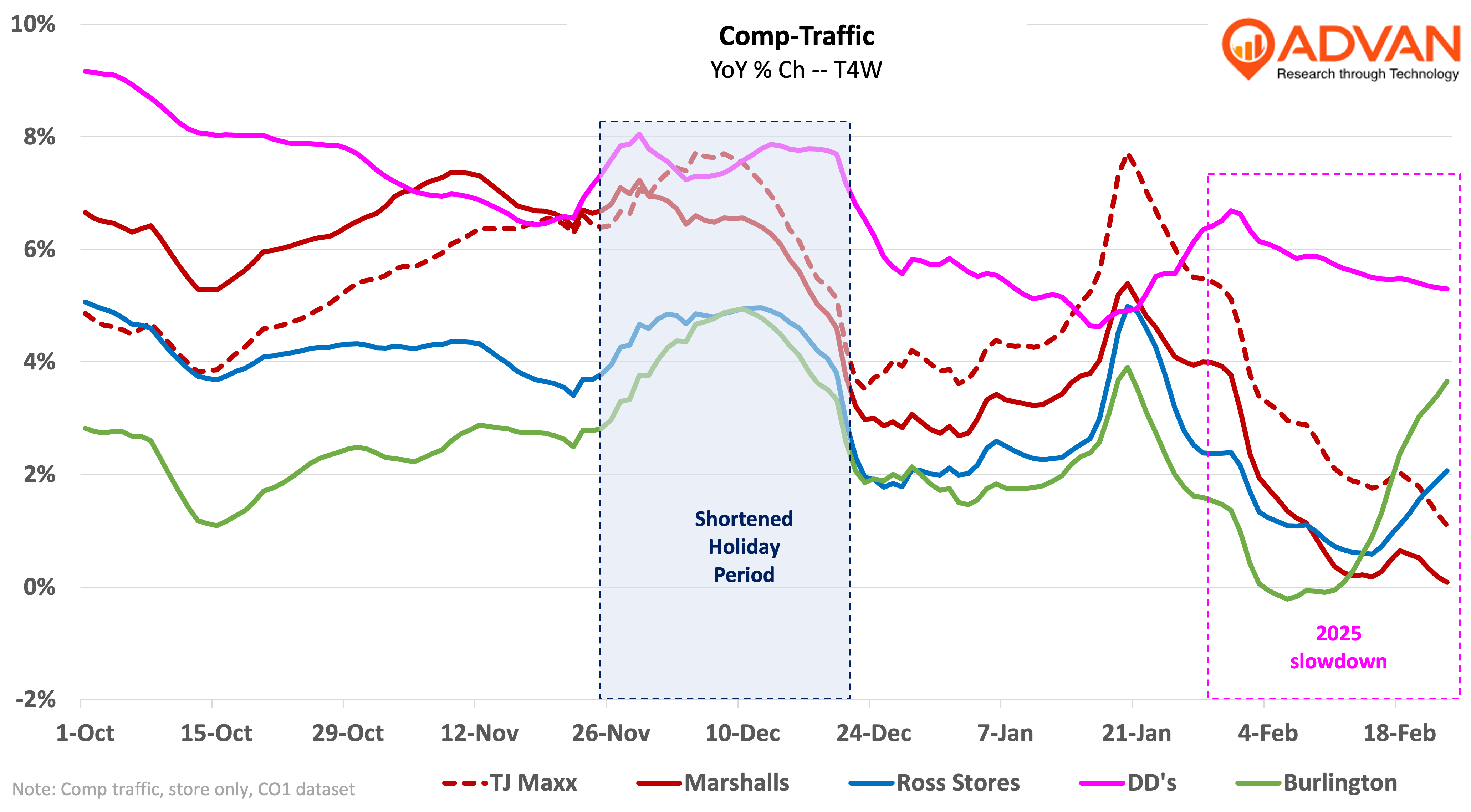

Ross Stores Inc. reported Q4 underlying sales up +3.5% and gross profits and operating income growth less. Sales growth was driven by Ross Dress for Less comp-traffic (+2.8% per Advan), comp-sales growth (+3%), and the new locations added earlier in...

By Thomas Paulson, Head of Market Insights

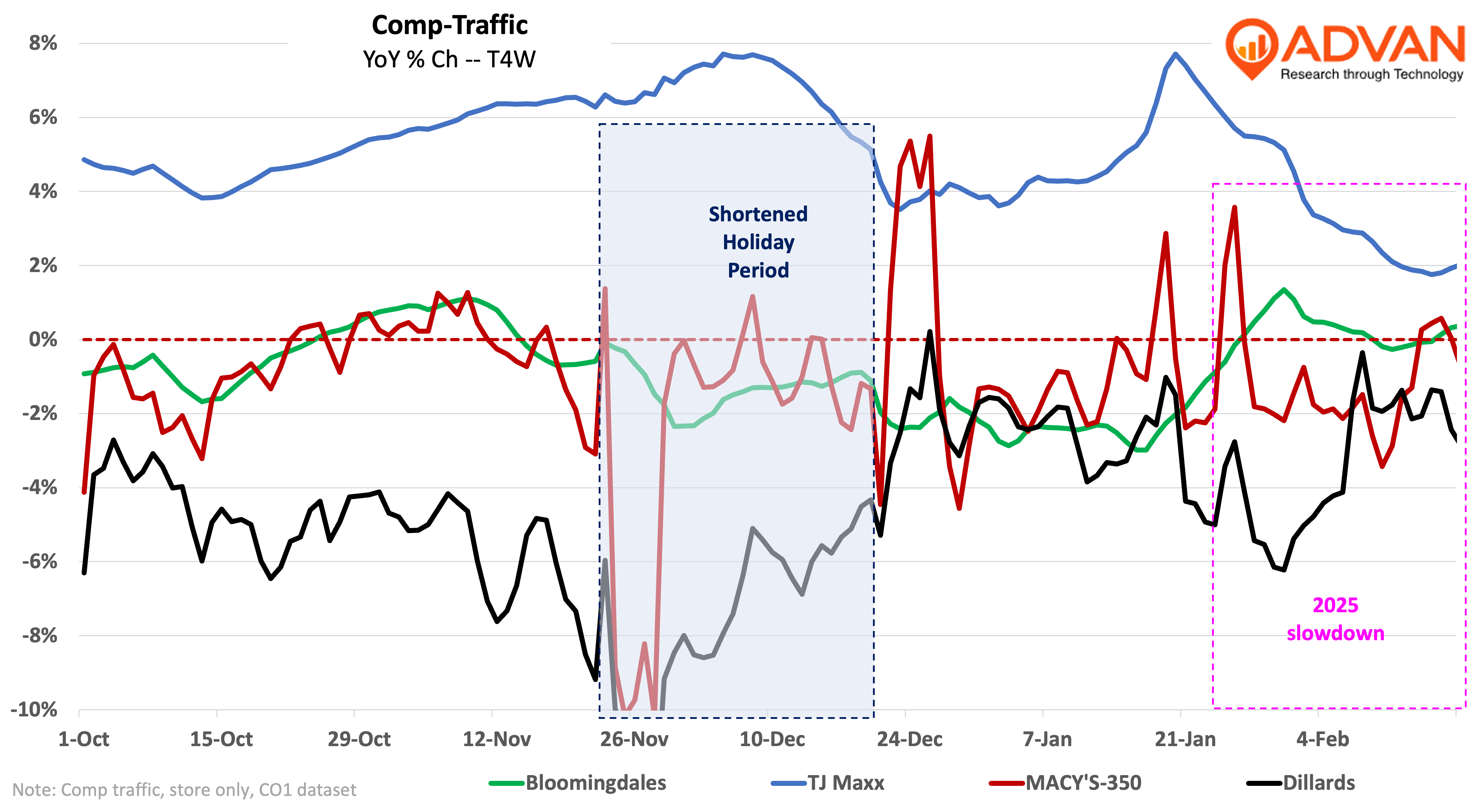

Macy’s Inc. reported improved holiday results as Advan previewed. Macy’s go-forward 350 reported a comp-sales decrease of -1.6%, roughly in-line with Dillard’s (-1%), and Bloomingdale’s reported a comp-sales increase of +4.8%, roughly in-line with...

As expected, Target reported improved results QoQ and issued seemly conservative guidance for 2025. We write “seemly” because of all the consumer and business unease being stirred by the hurricane in Washington. That unease is leading to lower macro activity, which for retail means a lower volume...